Contents:

Objective and Risk Analysis Pipeline

Risk Analysis Pipeline Details

Consolidated Important Risk Factors: GPT 4.5 Preview Model

Consolidated Important Risk Factors: o3-mini Model

Consolidated Important Risk Factors: o1-mini Model

Consolidated Important Risk Factors: o1 Model

Consolidated Important Risk Factors: DeepSeek R1 Model

Apply a Risk Mitigation Strategy Framework: Example using COSO ERM Framework

Get Started

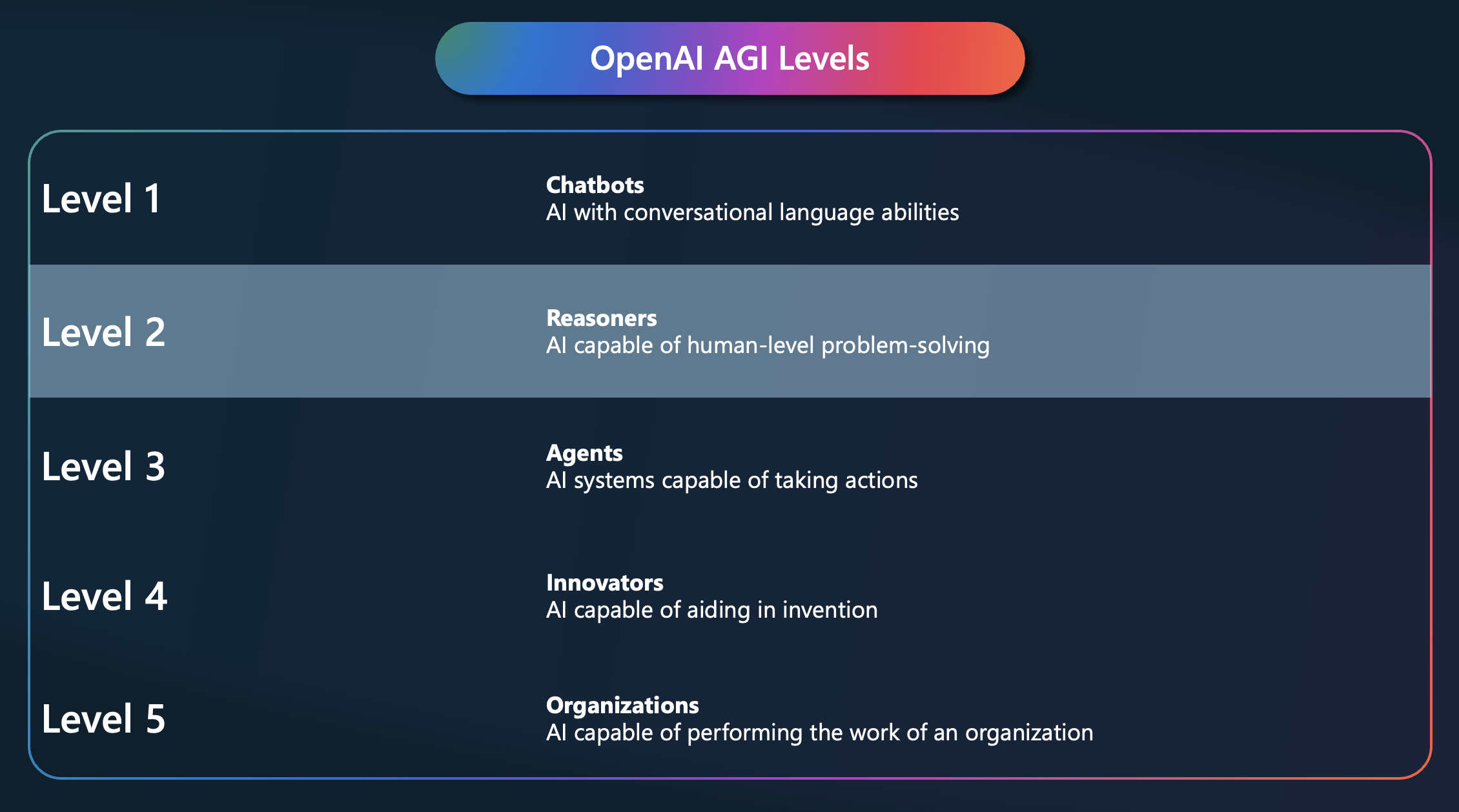

OpenAI’s reasoning model model series, currently including o1-mini, o1 and o3-mini, are cutting-edge logic processing engines. Unlike standard language models, they're optimized to handle complex, multi-step challenges that go beyond simple text generation, offering enhanced capabilities for problem-solving and logical reasoning. Additionally, these models include built-in mechanisms ideal for risk analysis, helping to ensure more reliable and safe outputs in critical decision-making tasks. While OpenAI pioneered reasoning AI models, DeepSeek R1 is an open-source reasoning model that demonsrates comparative performance.

The reasoning model series achieves this by optimizing the reasoning approach. Similarly to management consulting companies, these models break a problem down into smaller parts and "think" over a detailed approach. To come up with an optimized plan, these models can spend quite a bit of time achieving both an optimal approach and optimal outcome. Because these models can take many seconds (sometimes up to 35+ seconds) to return a reasoning answer, it does not make them ideal for real-time Generative AI scenarios like chat interfaces. However, these specific o1 models are ideal for business process workflows & pipelines where the better approach and outcome are sufficiently important.

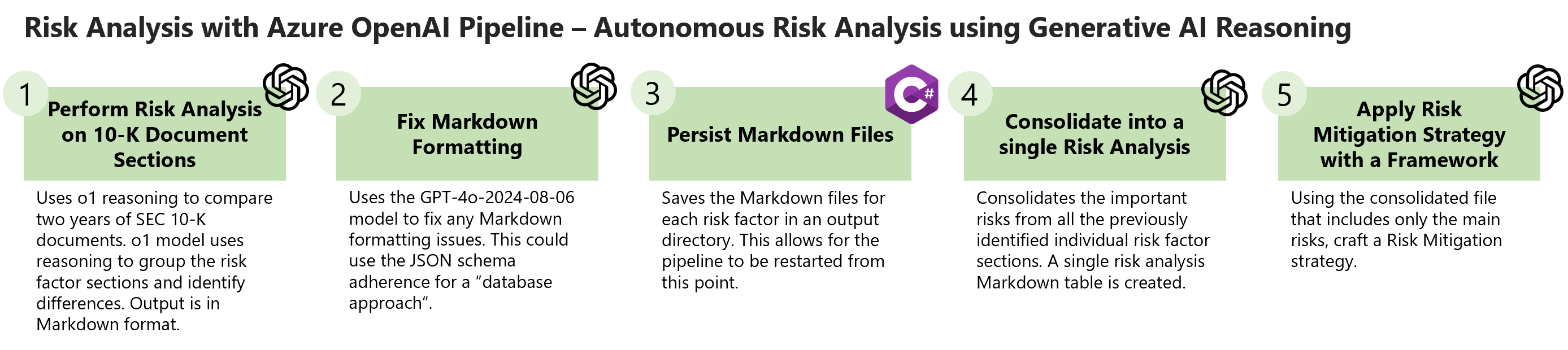

This repository includes a C# Console application that will orchestrate the following Risk Analysis Pipeline below:

The pipeline in the repository performs Risk Analysis over SEC 10-K documents. In simple terms, the 10-K is a big report that gives investors a clear picture of how well a public company is doing. These reports must be filed with the Securities and Exchange Commission (SEC) annually. Companies also have to disclose any potential risks they face in the 10-K, such as economic challenges, competition, legal issues, or changes in regulations. This helps investors understand what could go wrong with the company and how those risks might affect its future performance. These reports are typically analyzed by: investors, journalists, regulators, credit rating agencies, competitors etc. This makes a 10-K report ideal to validate if Generative AI advanced reasoning can be applied to risk analysis.

- The following two Microsoft SEC 10-k Documents are used from 2023 and 2024. Links below illustrate the Risk Factors areas:

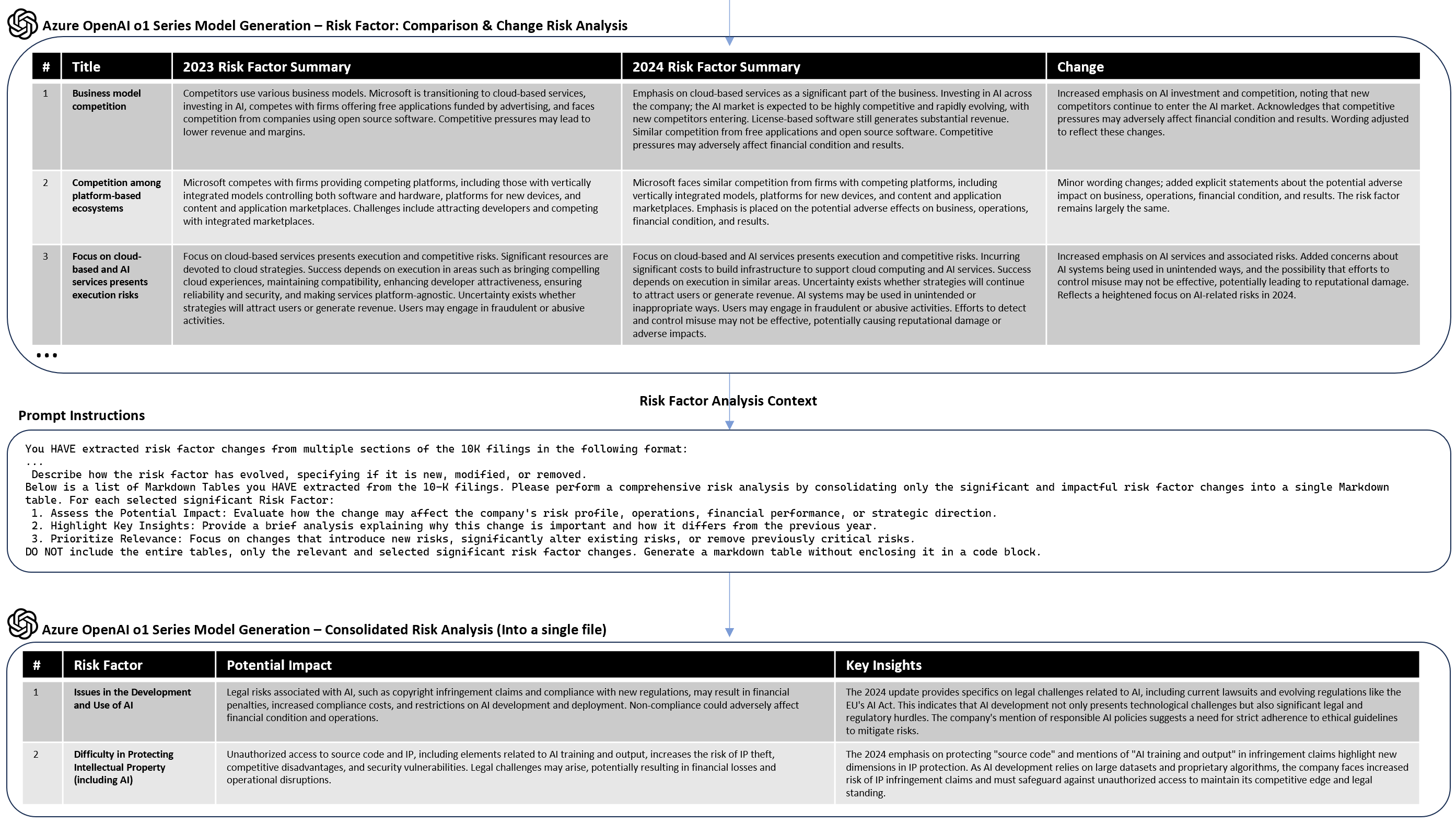

The image below illustrates how each Risk Factor section in the SEC 10-K documents is compared, analyzed by Generative AI. The identified differences are materialized as Markdown table files. This allows for experts to analyze the intermediate step and the workflow to begin from this state; bypassing the initial processing.

Navigate to the Risk Factor Analysis Sections: https://github.com/bartczernicki/RiskAnalysisWithOpenAIReasoning/tree/master/RiskAnalysisWithOpenAIReasoning/Output/o1-preview

Notice that each section contains several groups and certain risk factors do not change much (minor wording). An optimization would be to surface only the sufficiently important risk factor changes and persist the minor changes as intermediate steps. Therefore, in the next pipeline step, all of the generated 10-K Risk Factor sections are then consolidated into a single analysis that only surfaces the relevant risks into a single file. Examples of the single consolidated risk analysis are shown below for each respective o1 series model.

Note

Currently this application has "hard-coded" the SEC 10-K documents in a Data object. This was done to simplify and focus on the Generative AI risk analysis. There are many solutions like Azure Document Intelligence, that can provide the document segmantation to extract the Risk Factor sections dynamically.

Full analysis details: https://github.com/bartczernicki/RiskAnalysisWithGenerativeAIReasoning/tree/master/RiskAnalysisWithOpenAIReasoning/Output/gpt-4.5-preview

Below is a consolidated analysis of the significant and impactful risk factor changes between the 2023 and 2024 10-K filings.

| Number | Risk Factor | Change | Potential Impact | Key Insights |

|---|---|---|---|---|

| 1 | Cybersecurity and IT Security Threat Landscape | Explicitly detailed a major nation-state cyberattack from November 2023 impacting Microsoft email, internal systems, and ongoing implications, increasing transparency and risk awareness significantly from the general 2023 warnings. | Expanded recognition of this major incident sharply elevates the immediate operational and reputational risk exposure; potentially increasing operational costs, impacting customer confidence, and triggering increased regulatory scrutiny. | The inclusion of an explicit, impactful cyberattack incident underscores heightened vulnerability and signifies a more transparent acknowledgment of significant cyber risk occurrences. |

| 2 | Increasing Sophistication and Complexity of Cyberattacks | Expanded by explicitly highlighting the use of emerging technologies (AI and machine learning) by threat actors, along with underscoring challenges in investigation, mitigation, and containing sophisticated threats. | Enhances risks associated with sophisticated and advanced cyberattacks, raising potential incident response time, complexity, and remediation costs. Operational disruption could also intensify, harming Microsoft’s continuous service availability and overall reputation. | Explicit reference to AI-driven threats introduces an additional layer of complexity, underscoring the necessity for corresponding rapid evolution in defensive capabilities and strategies. |

| 3 | Misuse and Data Breaches of Customer/User Personal Data | Introduces specific concern regarding insider threats from internal personnel misusing customer and user data, adding a more explicit internal risk dimension compared to 2023. | Directly highlights the possibility of considerable reputational harm, regulatory penalties, and potential loss of customer trust stemming from internally driven data breaches or misuse, further intensifying operational controls and monitoring requirements. | Enhanced recognition of internal risks represents growing sensitivity toward internal vulnerabilities, potentially necessitating more stringent internal security oversight and access controls. |

| 4 | Issues Associated with AI Development and Deployment | Substantially expanded concerns include specific lawsuits alleging copyright infringement, the U.S. AI Executive Order, responsible AI practices, accuracy concerns, regulatory landscape evolution, and governance policies explicitly highlighted. | Broader scrutiny from stakeholders, governments, and regulatory bodies increases legal, compliance, reputational, and operational challenges significantly. Accelerated investment in responsible AI governance and compliance frameworks is likely necessary, increasing the cost and complexity of AI-driven products. | The considerable increase in specificity (legal actions, new regulations, and ethical considerations) represents Microsoft's heightened recognition of AI as a central and strategic risk concern, reflecting growing stakeholder scrutiny and the broader market’s concern about AI ethics and responsible development. |

| 5 | Competition Laws & Regulatory Actions | New mention of EU Digital Markets Act (DMA) explicitly designating Windows and LinkedIn as core platforms, significantly limiting certain business practices and data usage policies in key products and services. | Regulatory limitations on core products could introduce substantial financial and operational challenges, impacting competitive positioning, restricting strategic choices, and requiring costly compliance measures and potential business model adjustments. | Specific DMA references represents a substantial intensification in regulatory oversight, signifying urgent need to proactively adapt product and data strategies to European legislative realities. |

| 6 | Personal Data Regulations & GDPR | Significantly enhanced emphasis on increasing EU regulatory enforcement, higher fines, and explicit European regulatory actions blocking or removing services from markets for data privacy non-compliance. | Greatly increases compliance risk, potential business disruption, and elevated operational costs. Increased regulatory enforcement could substantially limit business scope or functionality in Europe, possibly reducing competitive advantage and market penetration. | Detailed references to enforcement actions and market blockage amplify legal and operational exposure significantly, underscoring a tightening European regulatory stance with tangible business impacts. |

| 7 | Sustainability Regulatory Requirements | Explicit identification as a new risk factor detailing increasing complexity around sustainability regulation and reporting, intensifying potential impacts including lawsuits, regulatory penalties, and reputational damage. | Introduces new dimensions of compliance and reporting, with associated higher operational costs. Implications include potential legal liabilities, reputational impacts, and intensified stakeholder expectations for transparency and sustainability progress. | New explicit inclusion reflects Microsoft's recognition of sustainability as strategically critical and subjected to intensifying scrutiny and regulation—aligning sustainability governance to key strategic and operational priorities. |

| 8 | Datacenter and Hardware Component Supply Risks | Significantly expanded via explicit emphasis on datacenter capacity requirements to support increasing AI-driven services and infrastructure, highlighting operational impacts from hardware shortages and supply chain disruptions. | Substantially elevates potential disruption risks from supply chain shortages and constraints, dramatically impacting operational continuity, service availability, and ability to scale AI-driven offerings. Financial risks of higher costs and delayed deployments could also intensify. | Explicit linkage to AI-driven demand growth exposes critical dependencies on a constrained hardware component supply chain, underscoring emerging AI infrastructure scaling challenges as strategically pivotal to maintain competitive differentiation and continuity of operations. |

| 9 | Risks from Acquisitions and Strategic Alliances | Updated to highlight the recently completed Activision Blizzard acquisition (Oct 2023) and explicit acknowledgment of ongoing FTC challenges potentially seeking to unwind or alter the completed deal. | Raises substantial legal, regulatory, and strategic risks post-acquisition. A forced unwind or operational restrictions imposed by the FTC could introduce significant strategic and financial instability, as well as substantial uncertainty around strategic direction and resource allocation. | Recognition of specific ongoing FTC challenges significantly amplifies regulatory risk around major transactions, indicating considerable uncertainty post-acquisition and highlighting regulatory-driven strategic vulnerabilities. |

| 10 | Business Model Competition and Cloud-based Services | Expanded explicitly to include AI as a core component in cloud strategy, with significant infrastructure investment for AI-focused services, emphasizing the necessity to deliver compelling user experiences alongside emerging pricing and delivery models. | Strategic alignment around AI increasingly drives competitive differentiation and risk. Intensified infrastructure investment and AI-driven innovation lead to higher operational costs, increased capital expenditures, and potential vulnerability to competitive breakthroughs or adoption challenges. | Strategic integration of AI fundamentally expands previous cloud-based risks, indicating a clear pivot toward AI as central in competitive dynamics and heightening importance around innovation, infrastructure scalability, and evolving business models. |

Full analysis details: https://github.com/bartczernicki/RiskAnalysisWithOpenAIReasoning/tree/master/RiskAnalysisWithOpenAIReasoning/Output/o3-mini

Below is a consolidated analysis of the significant and impactful risk factor changes between the 2023 and 2024 10-K filings.

| Number | Risk Factor | Change | Potential Impact | Key Insights |

|---|---|---|---|---|

| 1 | Operations & Infrastructure Risk | The 2024 filing now explicitly includes a dependency on water supply—alongside power and connectivity—and broadens the impact to overall business operations and financial condition. | Introducing water supply dependency exposes the company to environmental challenges such as drought or water scarcity, which can disrupt operations and financial stability, necessitating enhanced contingency and risk management plans. | By recognizing nontraditional infrastructure dependencies, the company signals a strategic shift to a broader risk framework that safeguards its operational continuity in the face of environmental challenges. |

| 2 | Supply Chain & Component Availability Risk | The report emphasizes proactive initiatives—like expanding datacenter locations and increasing server capacity to meet rising AI demand—while still cautioning about persistent supplier limitations for critical components. | While capacity expansion may ease some bottlenecks, continuing supplier constraints could cause delays, increase costs, and disrupt product delivery, potentially impacting revenue and market competitiveness. | This change illustrates the company’s balancing act between seizing new opportunities in AI and managing longstanding supply vulnerabilities, highlighting its strategic agility amid evolving market demands. |

| 3 | Reputation and Brand Risk | The 2024 summary expands risk factors to include new dimensions such as risks from controversial corporate philanthropic initiatives and potential AI deployment failures, in addition to traditional issues like data breaches. | Broadening reputational risks to include socio-political and ethical dimensions can lead to eroded customer trust, negative media attention, and ultimately, adverse impacts on market share and profitability if mismanaged. | The inclusion of nontraditional factors underscores that reputation now hinges on both technical performance and broader stakeholder perceptions, prompting the need for comprehensive crisis management and proactive public engagement. |

| 4 | Catastrophic Events and IT Disruption Risk | The filing now integrates supply chain disruptions into the list of catastrophic events affecting IT systems—expanding the focus beyond natural disasters and cyberattacks to include operational bottlenecks. | This integration expands the risk landscape, demanding more robust disaster recovery and business continuity plans that address interdependent threats, which may increase complexity and cost while challenging rapid recovery during disruptions. | By merging supply chain vulnerabilities with IT disruption risks, the change reflects a holistic view of modern operational threats and emphasizes the need for an integrated, cross‐functional risk management approach. |

| 5 | IT Security Risks | The 2024 update discloses a concrete incident—a nation-state password spray attack—and highlights that threat actors are now employing AI/ML techniques, underscoring challenges in rapid detection and response. | The disclosure of a real cybersecurity incident raises immediate concerns about the effectiveness of IT defenses, potentially leading to operational outages, regulatory scrutiny, and higher future investments in security measures. | Providing incident-specific details signals a more realistic and urgent approach to cybersecurity, with a focus on emerging, sophisticated, and technology-enabled threats that require rapid, coordinated responses. |

| 6 | Issues in the Development and Use of AI | The AI risk narrative has been significantly expanded to include explicit legal, regulatory, and ethical concerns—such as potential liabilities under emerging frameworks like the EU AI Act and U.S. Executive Order, and broader societal impacts. | Expanding the AI risk scope increases exposure to legal liabilities, regulatory pressures, and reputational harm, while also heightening competitive risks if AI deployments lead to unintended ethical or operational consequences. | The detailed expansion emphasizes that AI is not only a key technological opportunity but also a complex risk area requiring robust oversight, regulatory compliance, and long-term strategic planning to manage its multifaceted impacts. |

Full analysis details: https://github.com/bartczernicki/RiskAnalysisWithOpenAIReasoning/tree/master/RiskAnalysisWithOpenAIReasoning/Output/o1-mini

Below is a consolidated analysis of the significant and impactful risk factor changes between the 2023 and 2024 10-K filings.

| No. | Risk Factor | Change | Potential Impact | Key Insights |

|---|---|---|---|---|

| 1 | Sustainability Regulations | New: Introduction of sustainability regulatory requirements and related risks. | Compliance with new sustainability regulations may incur significant costs, require operational changes, and impact financial performance. Failure to meet sustainability goals could result in legal penalties and reputational damage. | The addition of sustainability risks highlights the growing importance of Environmental, Social, and Governance (ESG) factors. Aligning with global trends towards environmental responsibility can influence investor and consumer perceptions, making robust sustainability strategies crucial for maintaining competitive advantage and corporate reputation. |

| 2 | Data Privacy and Personal Data Regulations | Modified: Included additional references to the EU AI Act and other specific digital regulations. | Stricter data privacy laws and AI-specific regulations can increase compliance costs, limit data usage, and restrict product functionalities. This potentially reduces competitiveness and innovation while increasing the risk of hefty fines for non-compliance. | Incorporating AI-related data privacy regulations reflects the intersection of AI advancements with data protection. Comprehensive compliance strategies are necessary to navigate complex regulatory landscapes, safeguard user data, and ensure that AI developments do not compromise privacy standards. |

| 3 | Competition Laws and Enforcement | Modified: Added specifics regarding the EU Digital Markets Act and designated core platform services like LinkedIn. | Enhanced regulatory obligations under the EU Digital Markets Act could restrict business practices, limit market strategies, and lead to fines or operational changes. This affects growth and market positioning by imposing stricter compliance requirements on key platforms such as LinkedIn and Windows. | Detailing specific regulations like the EU Digital Markets Act provides clarity on the regulatory challenges faced. It emphasizes the need for strategic adjustments to comply with new legal standards, maintain market access, and avoid penalties, thereby safeguarding the company's competitive stance in major markets. |

| 4 | Protection and Utilization of Intellectual Property | Modified: Included protection of source code as part of IP challenges. | Enhanced risks around IP protection, especially source code, could lead to increased vulnerability to theft, reverse engineering, and competitive disadvantages. This may affect revenue streams and hinder innovation capabilities, potentially diminishing the company's technological edge and market share. | Emphasizing source code protection underscores the critical importance of safeguarding core software assets. Maintaining competitive advantage and customer trust relies on robust intellectual property strategies, ensuring that proprietary technologies remain secure against potential threats and unauthorized use. |

| 5 | Claims and Lawsuits | Modified: Expanded to include AI services and additional examples of potential claims. | Increased exposure to AI-related legal claims can result in higher legal costs, potential damages, and operational restrictions. This impacts financial stability and strategic initiatives in AI development, potentially delaying or scaling back innovative projects due to legal uncertainties and financial liabilities. | Addressing AI-specific legal risks highlights the importance of developing responsible AI systems. Proactively managing potential legal challenges associated with AI deployments and innovations is essential to mitigate risks, protect financial interests, and ensure the sustainable advancement of AI technologies within the company's portfolio. |

| 6 | Legal and Regulatory Requirements | Modified: Included specific references to AI Act and content moderation regulations. | Compliance with AI and content moderation laws may require significant operational adjustments and increased expenditures on regulatory compliance. These requirements could limit certain business activities, affecting overall business agility and profitability by imposing additional layers of oversight and control over AI-driven and content-related operations. | Highlighting AI and content moderation regulations emphasizes the critical need for governance frameworks that ensure compliance while fostering innovation. Balancing regulatory adherence with business growth objectives is vital to navigate the evolving legal landscape and maintain operational efficiency and market relevance. |

| 7 | Data Insights and Regulatory Constraints | Modified: Added specific mentions of AI services and reinforced the connection between data insights and regulatory constraints. | Regulatory constraints on data usage for AI services can limit data-driven innovation, increase compliance costs, and restrict monetization opportunities. This potentially affects the company's competitive edge and revenue streams by imposing stricter data handling and usage protocols, thereby hindering the full utilization of data assets for AI advancements. | Linking data insights with AI service regulations highlights the dependency of AI advancements on data availability and usage rights. Strategic data management and compliance are essential to leverage AI effectively without facing regulatory hindrances, ensuring that data-driven initiatives align with legal standards and contribute positively to the company's innovation and growth. |

Full analysis details: https://github.com/bartczernicki/RiskAnalysisWithOpenAIReasoning/tree/master/RiskAnalysisWithOpenAIReasoning/Output/o1

Below is a consolidated analysis of the significant and impactful risk factor changes between the 2023 and 2024 10-K filings.

| Number | Risk Factor | Change | Potential Impact | Key Insights |

|---|---|---|---|---|

| 1 | Competition Laws and Regulation | Regulatory scrutiny expanded under new frameworks (e.g., EU Digital Markets Act), designating Windows and LinkedIn as “core platform services” subject to increased obligations, potential fines, or forced product changes. | Could require substantial compliance investment and restrictions on how these platforms operate. Non-compliance risks include high fines, injunctions, and broader global enforcement, potentially limiting product features or market access. | Demonstrates a significant escalation in regulatory demands. Unlike 2023, the 2024 filing explicitly identifies more products as core services and highlights stricter enforcement. This elevates Microsoft’s competitive risks and may alter strategic product offerings. |

| 2 | Anti-Corruption and Trade Regulations | Incorporation of the EU Whistleblower Directive, expanded global trade sanctions, and heightened focus on partner/vendor compliance. | Adds complexity to compliance programs and increases the likelihood of investigations or whistleblower reports. Violations could lead to severe penalties, supply chain disruptions, or reputational damage. | Shifts the company’s risk profile by introducing new channels (whistleblower protections) for uncovering violations. The 2024 update highlights wider scope and intensifying international enforcement, marking a more complex compliance environment than in 2023. |

| 3 | Personal Data Handling | New EU regulations (Data Act, Digital Markets Act, etc.) add obligations around data transfers, with a risk of blocked services or removals for noncompliance, and significantly higher penalties than previously outlined. | Heightened compliance costs, exposure to larger fines, and potential service interruptions if data practices fail to meet cross-border rules. Could also disrupt customer trust and reduce product adoption in certain regions. | This change underscores regulators’ willingness to impose strict sanctions, including market blocks, not just fines. The 2024 focus broadens from GDPR to a suite of new EU data laws, marking a marked escalation in regulatory scrutiny compared to 2023. |

| 4 | Expanding Legal and Regulatory Obligations | Now explicitly includes sustainability, ESG, AI (e.g., EU AI Act), and cybersecurity rules. Also broadens obligations to comply with law enforcement data requests across more jurisdictions. | Greater operational complexity, potential for product feature restrictions, and unexpected costs to meet new regulatory requirements. Failing to comply may result in fines, reputational harm, or forced withdrawal from certain markets. | In 2023, the scope was broad but less specific; 2024’s iteration names AI and ESG as growing areas for regulation. The expanded detail suggests rapidly evolving obligations that could impact Microsoft’s innovation pace and public perception. |

| 5 | Claims and Lawsuits Risk | Recognizes newly emerging AI-related legal claims and broader product lines susceptible to novel lawsuits. | Increased risk of high-stakes litigation that might lead to injunctions halting AI offerings or substantial damage awards. Expanded product lines amplify the volume and complexity of potential legal disputes. | The 2023 filing mentioned general litigation, but 2024 adds AI-specific risks and acknowledges an expanding scope of potential claims. This shift elevates Microsoft’s litigation exposure and underscores the legal uncertainties inherent in AI. |

| 6 | Additional Tax Liabilities | Disclosure of a major IRS transfer pricing dispute (NOPAs totaling $28.9B) plus heightened global tax initiatives (e.g., global minimum tax), suggesting higher exposure and financial risk. | Could materially increase effective tax rates and lead to significant payouts if disputes are resolved unfavorably. Risk of protracted litigation or negotiations, which can affect financial statements and strategic resource allocation. | This is a major development from prior years, highlighting a substantial jump in potential tax exposure. The specificity of the IRS claim and mention of global minimum tax underscores a materially heightened tax risk compared to 2023. |

| 7 | Evolving Sustainability Requirements (New) | Newly added factor emphasizing rising ESG regulations, climate commitments, and disclosure obligations. Failure to meet stated environmental targets or reporting mandates can lead to legal actions or reputational harm. | Potentially large investments to fulfill sustainability goals, and increased vulnerability to lawsuits or stakeholder criticism if perceived to be falling short. Reputational damage could undermine customer and investor trust. | This risk did not exist in 2023, revealing how quickly ESG pressures have become mainstream. The 2024 addition signals that sustainability has moved from a voluntary target to a regulated, and potentially litigated, aspect of the company’s operations and public commitments. |

Full analysis details: https://github.com/bartczernicki/RiskAnalysisWithGenerativeAIReasoning/tree/master/RiskAnalysisWithOpenAIReasoning/Output/deepseek-r1-distill-qwen-32b

Below is a consolidated analysis of the significant and impactful risk factor changes between the 2023 and 2024 10-K filings.

| Number | Risk Factor | Change | Potential Impact | Key Insights |

|---|---|---|---|---|

| 1 | Cyberattacks and Security Vulnerabilities | 2024 includes a specific incident (nation-state attack using password spray) and more detailed consequences, such as financial impact on operations. | Introduces new risks by specifying actual incidents and their direct financial implications, indicating heightened vulnerability to cyber threats and increased operational challenges. | The inclusion of real-world incidents highlights the growing sophistication of attacks and the potential for severe financial repercussions, signaling a shift in risk management focus. |

| 3 | AI Risks | Expanded to include regulatory impacts like the EU's AI Act and U.S. executive orders. | Adds new compliance challenges, reflecting global regulatory efforts in AI governance, which could affect Microsoft's AI product development and market access. | The expansion underscores the increasing importance of regulatory compliance in AI, aligning with global trends toward stricter AI regulations. |

| 4 | Reputation and Brands Damage | Added mention of AI failures and corporate philanthropy; more specific on cybersecurity incidents. | Introduces new risks related to AI failures and philanthropic initiatives, which could harm Microsoft's reputation if mishandled. | The addition reflects the growing scrutiny of corporations in areas beyond traditional business operations, including their social impact and ethical practices. |

| 5 | Catastrophic Events and Geopolitical Risks | Added supply chain issues and broader geopolitical impact discussion. | Expands the scope of risks to include supply chain disruptions, which could affect global operations and market access, indicating heightened awareness of geopolitical tensions' operational impacts. | The expansion highlights the interconnectedness of geopolitical risks with supply chain resilience, a critical concern in today's volatile international environment. |

| 6 | Legal Changes Impacting IP | Expanded focus on how increasing engagement with open-source software affects IP strategy and licensing obligations. | Adds new risks related to open-source software licensing, which could complicate Microsoft's IP management and introduce compliance challenges. | The change reflects the growing prevalence of open-source technologies and their implications for intellectual property strategies in a competitive landscape. |

| 7 | Source Code Leakage Risks | Emphasized the connection between source code leaks and increased security vulnerabilities described elsewhere in the document. | Introduces new risks by linking source code leaks to broader security challenges, indicating potential cascading effects on overall IT infrastructure and data security. | This change underscores the criticality of source code security in an increasingly interconnected digital environment, where a single leak could have far-reaching consequences. |

| 8 | Infringement Claims | Added context about current claims arising from AI training and output, reflecting emerging risks in the AI sector. | Introduces new risks related to AI-related copyright infringement claims, which could affect Microsoft's AI initiatives and expose it to legal liabilities. | The addition highlights the evolving nature of intellectual property disputes in the AI space, particularly as companies increasingly rely on AI for product development. |

| 9 | Government Litigation and Competition Laws | Expanded to include new market regulation schemes like the EU Digital Markets Act, which specifically targets platforms like Windows and LinkedIn with obligations. | Adds significant regulatory challenges, potentially affecting Microsoft's core platforms and requiring substantial compliance efforts. | The expansion reflects increasing regulatory scrutiny of tech giants, particularly in Europe, aiming to level the playing field and regulate dominant market players. |

| 10 | Data Handling and Privacy Laws | Added specific examples of enforcement actions (e.g., blocking U.S.-based services) and emphasized the growing complexity of data regulation, particularly for AI services. | Introduces new risks related to stricter data regulations and their potential impact on Microsoft's global operations, especially in Europe. | The change underscores the increasing complexity and stringency of privacy laws, particularly as they apply to advanced technologies like AI. |

| 11 | Tax Liabilities | Expanded to include a specific example of tax disputes (IRS audit with $28.9 billion proposed adjustment) and global tax reforms like the OECD's minimum tax proposals. | Adds significant financial risks related to tax disputes and regulatory changes, which could affect Microsoft's profitability and cash flow. | The inclusion of a high-profile IRS audit and OECD tax reforms highlights the potential for substantial financial losses due to evolving tax policies and increased scrutiny. |

| 12 | Sustainability Regulatory Requirements | Introduced as a new risk factor in 2024, reflecting the growing importance of ESG compliance and Microsoft's sustainability goals. | Introduces new risks related to environmental, social, and governance regulations, which could affect Microsoft's operations and reputation if not adequately addressed. | The addition reflects the global trend toward stricter ESG requirements and aligns with Microsoft's stated commitment to sustainability, making it a critical area for risk management. |

| 13 | Hardware Defects | Introduced as a standalone risk factor in 2024, separating hardware issues from software concerns. | Adds new risks related to hardware defects, which could lead to recalls, safety alerts, and operational disruptions, impacting Microsoft's reputation and financial performance. | The introduction of a dedicated risk factor for hardware defects indicates growing concerns about product quality in Microsoft's hardware offerings, reflecting increased competition and consumer expectations. |

| 15 | Fraudulent or abusive activities | Expanded the scope to include misuse of AI systems in addition to cloud-based services. | Adds new risks related to potential fraudulent activities through AI systems, which could harm Microsoft's reputation and expose it to legal liabilities. | The change highlights the dual-edged nature of AI advancements, where their benefits are accompanied by new vulnerabilities that require proactive risk management strategies. |

Reasoning models can not only can craft a multi-step risk analysis, but can also apply a risk mitigation strategy framework to draft a strategic approach. Below is a sample output using the OpenAI o3-mini series to apply the COSO ERM Framework on the consolidated risk analysis from the Microsoft SEC 10-K Documents:

Applying the COSO ERM Framework to Mitigate Identified Risks

Below is an integrated set of risk mitigation strategies for the six highlighted Microsoft risk factors. The recommendations follow the key COSO ERM components—Internal Environment (governance and culture), Objective Setting, Event Identification, Risk Assessment, Risk Response, Control Activities, and Information, Communication & Reporting—to ensure that risks are managed holistically and proactively.

Below is a set of risk mitigation recommendations organized around the COSO ERM components (Internal Environment, Objective Setting, Event Identification, Risk Assessment, Risk Response, Control Activities, Information & Communication, and Monitoring). These recommendations address each of the identified risk factors from Microsoft’s consolidated risk analysis:

• Internal Environment & Objective Setting:

– Embed an enterprise‐wide culture of compliance by establishing a clear risk appetite for regulatory challenges.

– Incorporate digital market regulation into strategic objectives, ensuring that all business units are aligned with new regulatory requirements (e.g., under the EU Digital Markets Act).

• Event Identification & Risk Assessment:

– Continuously monitor regulatory developments across all jurisdictional markets (US, EU, UK, China) to identify any emerging mandates or policies.

– Use scenario analysis and impact assessments to evaluate how potential regulatory changes could affect product design, marketing, or cost structures.

• Risk Response & Control Activities:

– Develop proactive compliance programs and embed them in internal controls (e.g., regular audits, compliance checkpoints) to adjust product and service designs promptly.

– Consider risk-sharing responses where appropriate (such as lobbying or partnerships with industry groups) to help shape favorable regulatory outcomes.

• Information & Communication and Monitoring:

– Ensure clear, timely communication between regulatory affairs, business units, and the board to disseminate new risks and discuss mitigation plans.

– Regularly review and update risk dashboards and conduct periodic stress tests to confirm that controls remain effective amid evolving digital market regulations.

• Internal Environment & Objective Setting:

– Strengthen a data–protection culture by setting high standards for privacy and compliance, linking these objectives to overall strategic priorities.

– Ensure that board-level risk oversight includes data privacy as a core component.

• Event Identification & Risk Assessment:

– Implement advanced tools to monitor cross-border data flows and alerts for service disruptions or regulatory enforcement actions.

– Conduct regular privacy impact assessments, particularly before launching new digital services or features that could trigger stricter enforcement.

• Risk Response & Control Activities:

– Update and enforce robust privacy policies and control activities (e.g., encryption, access controls, and incident response plans) to minimize the likelihood and impact of service blockages or fines.

– Train employees on up-to-date compliance practices to reduce the risk of inadvertent breaches.

• Information & Communication and Monitoring:

– Establish transparent communication channels to report potential data mishandling issues both internally and externally.

– Periodically reassess controls through internal audits and regulatory reviews to ensure ongoing compliance with international data privacy requirements.

• Internal Environment & Objective Setting:

– Integrate ESG and sustainability into the company’s mission and risk appetite by setting specific targets (e.g., carbon negativity, zero waste) as strategic objectives.

– Ensure leadership obtains accountability for sustainability performance.

• Event Identification & Risk Assessment:

– Map regulatory changes and stakeholder expectations related to ESG to identify new risks or compliance gaps.

– Use materiality assessments to gauge the potential impact of failing to meet ESG commitments on legal liabilities and reputational damage.

• Risk Response & Control Activities:

– Develop and implement ESG–driven control activities, including environmental management systems, sustainability reporting tools, and corporate governance frameworks that address emerging sustainability standards.

– Invest in technologies and processes that support ESG targets while reducing costs and reputational risks.

• Information & Communication and Monitoring:

– Publish regular ESG performance reports and engage with stakeholders (investors, regulators, and the public) to reflect transparency.

– Monitor progress against sustainability goals using key performance indicators (KPIs) and adjust initiatives based on feedback and evolving regulatory benchmarks.

• Internal Environment & Objective Setting:

– Cultivate a culture of transparency and ethical behavior regarding tax practices, setting clear standards for tax compliance across all jurisdictions.

– Align tax risk management with the overall strategic objectives of the enterprise.

• Event Identification & Risk Assessment:

– Enhance risk identification processes to monitor legislative changes, IRS audit triggers (such as Notices of Proposed Adjustment), and global tax proposal shifts, including the global minimum tax.

– Use quantitative risk assessments to simulate potential liabilities and earnings volatility under different audit scenarios.

• Risk Response & Control Activities:

– Structure a dedicated tax risk management function that develops responsive control activities, audit preparedness practices, and contingency plans for multi–billion-dollar exposures.

– Enhance internal review and external audit protocols to better anticipate and address areas of risk exposure.

• Information & Communication and Monitoring:

– Regularly communicate tax risk exposures and management strategies to the executive team and board, ensuring alignment and rapid decision–making when regulatory changes occur.

– Establish continuous monitoring of tax positions with periodic reviews and gap analyses to update forecasts and risk registers.

• Internal Environment & Objective Setting:

– Define clear standards for ethical behavior and corporate responsibility that encompass emerging areas like AI development and corporate philanthropy.

– Set reputation management as a core strategic objective, aligning risk tolerances with brand integrity goals.

• Event Identification & Risk Assessment:

– Implement mechanisms (sentiment analysis tools, social media monitoring) to detect early warning signs of reputational damage related to product failures, AI controversies, or missteps in social initiatives.

– Conduct risk assessments that specifically identify vulnerabilities in technology development and public perception.

• Risk Response & Control Activities:

– Integrate crisis management and rapid response strategies—such as enhanced quality assurance, independent audits of AI systems, and coordinated public–relations plans—to mitigate negative events.

– Develop cross–functional risk response teams that routinely test scenarios and update action plans, ensuring that controls remain robust against unforeseen challenges.

• Information & Communication and Monitoring:

– Foster transparent communication with all stakeholders (customers, partners, media, and internal teams) before, during, and after potentially damaging events.

– Use ongoing monitoring and feedback loops (e.g., market research and audience sentiment reports) to refine strategies and adjust risk responses as needed.

• Internal Environment & Objective Setting:

– Establish a culture that prioritizes resilience and business continuity, ensuring that operational risk is integrated into the overall risk appetite.

– Set clear objectives for recovery times, system uptime, and supply chain robustness within the strategic plan.

• Event Identification & Risk Assessment:

– Develop detailed risk mapping to identify potential catastrophic events (natural disasters, cyberattacks, supply chain interruptions) that could affect cloud services and other critical operations.

– Employ scenario planning and stress testing to understand the likelihood and impact of prolonged outages or supply chain disruptions.

• Risk Response & Control Activities:

– Create and regularly update comprehensive business continuity and disaster recovery plans—including redundancies, backup systems, and alternative supply chain sources—to respond to identified risks.

– Strengthen IT and cybersecurity controls through continuous investment and regular simulation drills, ensuring technical resilience against cyber threats and environmental disruptions.

• Information & Communication and Monitoring:

– Set up clear communication channels to alert internal teams and customers as soon as operational disruptions are detected, facilitating a rapid coordinated response.

– Monitor recovery indicators with a dedicated oversight team that performs regular audits and post–incident reviews to improve future responses.

• Internal Environment & Objective Setting:

– Uphold a robust ethical and legal culture that recognizes the complexities of emerging legal claims, particularly in high–tech and AI domains.

– Integrate litigation risk into the company’s strategic objective–setting process, ensuring that innovation initiatives include legal viability reviews.

• Event Identification & Risk Assessment:

– Utilize legal and regulatory surveillance tools to identify evolving claims and lawsuits (including those stemming from novel AI use and expanded business domains).

– Conduct scenario analyses to estimate potential financial liabilities, the frequency of litigation events, and their potential disruption to operations.

• Risk Response & Control Activities:

– Develop proactive legal risk management strategies (e.g., strengthened contractual terms, increased insurance coverage, and frequent internal legal audits) to reduce overall exposure.

– Embed risk mitigation measures in product development processes so that legal implications are factored in early, thereby reducing the likelihood and consequence of future claims.

• Information & Communication and Monitoring:

– Maintain an active dialogue with legal, regulatory, and compliance experts to ensure that emerging risks are quickly communicated and that the risk response remains agile.

– Regularly review litigation trends and outcomes, using the findings to adapt risk management practices and to update risk registers on a continuous basis.

By leveraging the eight COSO ERM components, Microsoft can create an integrated risk management framework that not only anticipates emerging challenges across domains—from digital market regulation to ESG and litigation—but also implements agile, proactive responses. The recommended strategies stress the importance of:

• Establishing a strong internal culture of compliance and resilience.

• Setting clear strategic objectives that incorporate risk mitigation targets.

• Identifying and assessing risks continuously through scenario planning and advanced monitoring.

• Crafting targeted risk responses combined with robust control activities.

• Facilitating open channels of communication and ongoing monitoring to adjust strategies in real time.

These measures, embedded in the COSO ERM framework, will enable the company to better navigate a complex global landscape, minimize disruptions, and safeguard Microsoft’s market position and reputation over the long term.

- .NET 9.x SDK Installed: https://dotnet.microsoft.com/en-us/download/dotnet/9.0

- Azure OpenAI API Access: (OpenAI Access will work as well) either o1-mini/o3-mini/o1 and GPT-4o models deployed and API key

- Visual Studio 2022(+) if debugging the solution with an IDE

git clone https://github.com/bartczernicki/RiskAnalysisWithOpenAIReasoning.git

Add this to the Secrets.json (Right Click on VS Project -> Manage User Secrets) and run the console application

{

"AzureOpenAI": {

"AzureOpenAIType": "PAYGO",

"reasoningEndpoint": "https://YOURAZUREOPENAIENDPOINT.openai.azure.com/"

"reasoningModelDeploymentName": "o1-preview",

"reasoningAPIKey": "YOURAZUREOPENAIKEY",

"gpt4oEndpoint": "https://YOURAZUREOPENAIENDPOINT.openai.azure.com/"

"gpt4oModelDeploymentName": "gpt-4o-2024-08-06-global",

"gpt4oAPIKey": "YOURAZUREOPENAIKEY"

},

"DeepSeek": {

"DeepSeekModelName": "deepseek-r1-distill-qwen-32b",

"DeepSeekAPIKey": "NOLOCALAPIKEY",

"DeepSeekAPIEndpoint": "http://192.168.1.212:1234/v1/"

}

}